Global employee benefits and total rewards platform

Engage your employees anytime, anywhere.

Because people matter.

Our award-winning platform and app helps employers create an exceptional benefits and rewards experience for their most valuable asset throughout the entire employee lifecycle.

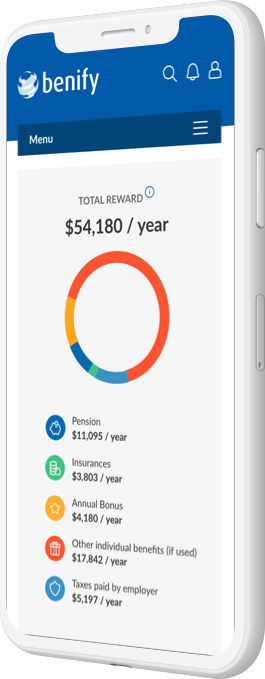

Make employees aware of your full investment. A Total Reward Statement reflects employees’ total reward and compensation, including benefits and other add-ons, so they understand their true value of their employment.

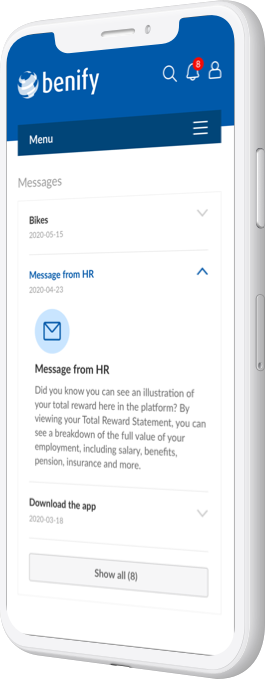

Use the platform’s integrated communication tool to send personalized, targeted messages. Send the right message to the right people using the right channel. Best yet, you can engage your workforce wherever they are through the Benify app by using push notifications.

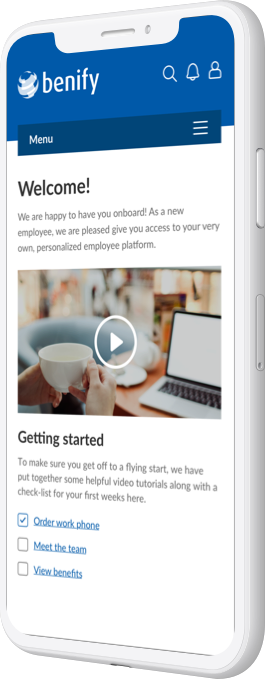

Before starting their first day, right through to their final day, digitalize the employee lifecycle with the platform’s preboarding, onboarding and offboarding tools. Enable employees to enroll in benefits digitally via desktop or through the app and reduce administration in the process.

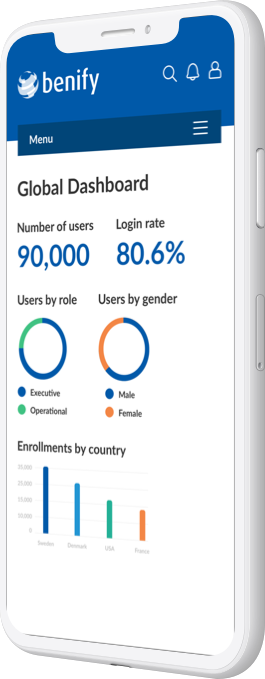

Manage your entire global workforce from a single source. With a global-but-local approach, administrators can gain insights from benefits and compensation data to assist with strategic decision making.

Benify in numbers

Benify customers

million employees use our platform

customer retention

Why choose Benify?

We are 100% independent and agnostic. Our market-leading benefits and total rewards platform is truly mobile. Combined with our 250 dedicated employees in Product and Development, our global but local approach means we have the ability and expertise to service each market and country individually.

Best yet, our SaaS (software as a solution) platform includes its own in-built data mapping tool allowing it to integrate with your existing on-premise or cloud platforms to ensure a seamless user experience.